Bookkeeping apps are software applications designed to help individuals and businesses manage their financial transactions, recordkeeping, and bookkeeping processes. These apps typically provide features such as expense tracking, income recording, invoicing, bank reconciliation, financial reporting, and sometimes integration with accounting software.

Why Use a Bookkeeping App?

Using a bookkeeping app offers numerous advantages for individuals and businesses. Firstly, it provides organization and accuracy. These apps offer a structured system for recording financial transactions, categorizing expenses, and tracking income. By automating the process, you reduce the chances of errors and ensure that your financial data is organized and reliable.

Secondly, bookkeeping apps save you time. By automating manual tasks such as data entry, receipt scanning, and bank reconciliation, these apps streamline your bookkeeping processes. This frees up time for you to focus on other important aspects of your business or personal finances.

Thirdly, bookkeeping apps provide valuable financial insights. They generate reports such as profit and loss statements, balance sheets, and cash flow statements, giving you a clear understanding of your financial position. These insights help you make informed decisions, identify trends, and monitor the financial health of your business or personal finances.

Additionally, bookkeeping apps offer invoicing and payment tracking features. You can create professional invoices, track payments, and manage outstanding balances within the app. This simplifies your billing process and ensures timely payments from clients or customers.

Furthermore, these apps provide accessibility and mobility. Many bookkeeping apps have mobile versions or cloud-based access, allowing you to manage your finances from anywhere, at any time. You can access your financial data, enter transactions, and review reports on your smartphone or tablet, providing flexibility and convenience.

Lastly, bookkeeping apps often integrate with accounting software. If you already use accounting software for your business, integrating it with a bookkeeping app ensures that your bookkeeping data syncs seamlessly with your accounting system. This eliminates the need for manual data entry and reduces the risk of errors.

Overall, using a bookkeeping app simplifies financial management, saves time, improves accuracy, and provides valuable insights into your financial position. Whether you’re a small business owner, freelancer, or an individual managing personal finances, a bookkeeping app can be a valuable tool for maintaining financial organization and making informed decisions.

With all that in mind, let’s take a look at our top picks of the bookkeeping apps on iOS.

1. QuickBooks

QuickBooks is a comprehensive bookkeeping app that offers a range of features for small businesses. Its iPhone app provides a user-friendly interface, allowing you to manage your finances on the go. With QuickBooks, you can track income and expenses, create and send professional invoices, and generate financial reports.

The app seamlessly syncs with the web and desktop versions of QuickBooks, ensuring that your data is always up to date across all devices. QuickBooks also offers integrations with various business tools, providing a streamlined bookkeeping experience.

2. Xero

Xero’s iPhone app is a powerful bookkeeping tool designed for small businesses. It offers robust features such as bank reconciliation, expense tracking, invoicing, and financial reporting. The app allows you to view and manage your cash flow in real-time, making it easier to stay on top of your finances.

Xero integrates with numerous third-party apps and services, enabling you to streamline other aspects of your business operations. The app’s intuitive interface and extensive functionality make it a popular choice among business owners and accountants alike.

3. FreshBooks

FreshBooks’ iPhone app is a user-friendly bookkeeping solution tailored for small businesses and freelancers. The app offers a range of features, including time tracking, invoicing, expense management, and financial reporting. With FreshBooks, you can create professional-looking invoices, track your billable hours, and easily manage your expenses on the go.

The app provides valuable insights into your financial health, helping you make informed decisions for your business. FreshBooks’ intuitive design and ease of use make it an excellent option for those who prioritize simplicity and efficiency in their bookkeeping processes.

4. Wave

Wave’s iPhone app is a free and powerful bookkeeping tool for small businesses. It provides a variety of features, including invoicing, expense tracking, receipt scanning, and financial reporting. Wave’s app allows you to easily manage your income and expenses, generate professional invoices, and track your business’s financial performance.

The app also integrates with Wave’s other tools, such as payroll and payments, offering a comprehensive financial management solution. With Wave, you can access your financial data anytime, anywhere, making it a convenient option for entrepreneurs on the move.

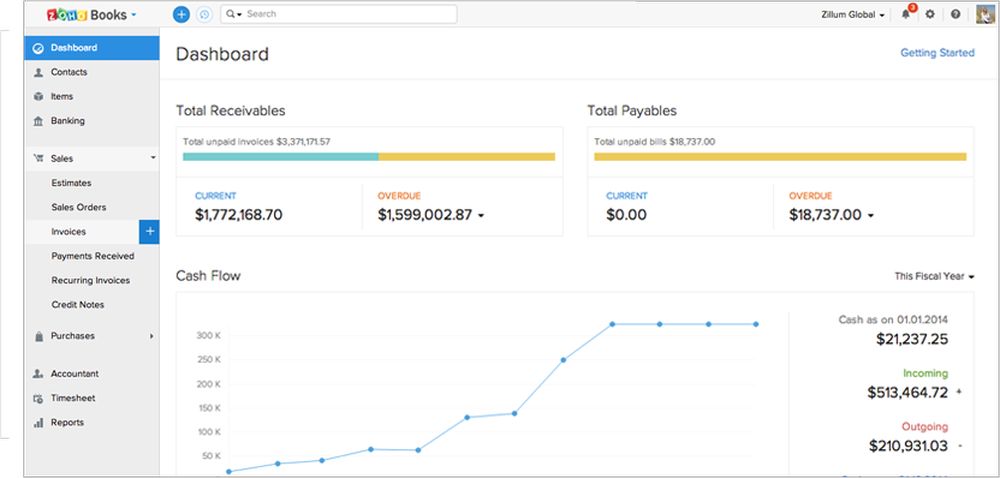

5. Zoho Books

Zoho Books’ iPhone app is a feature-rich bookkeeping solution suitable for small businesses. The app offers functionalities like invoicing, expense tracking, bank reconciliation, and financial reporting. Zoho Books provides a user-friendly interface that allows you to manage your finances efficiently.

The app seamlessly integrates with other Zoho apps, such as Zoho CRM and Zoho Expense, providing a cohesive business management experience. With Zoho Books, you can stay organized, track your cash flow, and make informed financial decisions.

6. Expensify

Expensify’s iPhone app is primarily focused on expense management. It simplifies the process of tracking and categorizing expenses, offering features like receipt scanning, automatic expense report creation, and reimbursement management. The app allows you to capture receipts on the go, track mileage, and manage your expense records effortlessly.

Expensify also integrates with popular accounting software, streamlining the expense reporting process for businesses. With its emphasis on expense management, Expensify is an ideal choice for businesses that prioritize efficient expense tracking and reimbursement workflows.

7. Kashoo

Kashoo’s iPhone app offers a user-friendly bookkeeping experience, particularly suitable for small businesses. The app provides features such as invoicing, expense tracking, bank reconciliation, and financial reporting. Kashoo allows you to generate professional invoices, manage your expenses, and gain valuable insights into your business’s financial health.

The app is designed to be intuitive and straightforward, making it accessible to users who may not have extensive accounting knowledge. Kashoo’s focus on simplicity and efficiency makes it a solid choice for entrepreneurs looking for a hassle-free bookkeeping solution.

8. ZipBooks

ZipBooks’ iPhone app is designed to simplify bookkeeping for small businesses. The app offers features like time tracking, invoicing, expense management, and financial reporting. With ZipBooks, you can easily track your working hours, create professional invoices, manage your expenses, and gain insights into your financial performance.

The app aims to streamline the bookkeeping process and provide users with a clear overview of their business finances. ZipBooks’ user-friendly interface and extensive functionality make it a suitable choice for businesses seeking a comprehensive bookkeeping solution.

9. Zoho Expense

Zoho Expense is a dedicated expense management app for iPhone. The app allows you to capture receipts, track expenses, submit expense reports, and get reimbursed. Zoho Expense simplifies the process of managing and categorizing expenses, making it easy to track your business’s spending.

The app seamlessly integrates with other Zoho apps, such as Zoho Books, ensuring a smooth flow of expense data across your business management tools. Zoho Expense’s focus on efficient expense tracking and management makes it a valuable tool for businesses looking to streamline their expense processes.

10. Billy

Billy is a straightforward bookkeeping app for iPhone that emphasizes simplicity and ease of use. The app offers features like invoicing, expense tracking, bank reconciliation, and financial reporting. With Billy, you can create professional invoices, track your expenses, and generate financial reports with ease.

The app is designed with small businesses and freelancers in mind, providing a user-friendly interface and intuitive features. Billy’s straightforward approach to bookkeeping makes it a convenient choice for individuals who want a simple yet effective solution for managing their financial records.

In conclusion

Bookkeeping apps have revolutionized the way individuals and businesses manage their financial records. These powerful tools bring organization, accuracy, and efficiency to the bookkeeping process, saving time and reducing the risk of errors. With features like expense tracking, invoicing, financial reporting, and integration with accounting software, bookkeeping apps provide comprehensive solutions for financial management.

The accessibility and mobility offered by these apps allow users to manage their finances on the go, providing flexibility and convenience. The ability to access financial data, enter transactions, and review reports from anywhere, at any time, empowers individuals and business owners to stay on top of their financial health.

Moreover, bookkeeping apps provide valuable insights into financial performance. The generation of reports such as profit and loss statements, balance sheets, and cash flow statements offers a clear overview of the financial position. These insights enable informed decision-making, identify trends, and support strategic planning.

By simplifying the bookkeeping process, bookkeeping apps empower individuals and businesses to focus on what truly matters – growing their businesses, managing finances effectively, and achieving their financial goals. Whether you’re a small business owner, freelancer, or an individual managing personal finances, leveraging the power of bookkeeping apps can enhance financial organization, accuracy, and productivity.

In the digital era, bookkeeping apps have become indispensable tools for financial management, and their continued evolution promises even greater convenience and features in the future. Embracing these technological solutions ensures that individuals and businesses can navigate the complexities of bookkeeping with ease, enabling them to thrive in an increasingly competitive landscape.