Bookkeeping apps are software applications that help individuals and businesses manage financial transactions and recordkeeping. They offer features like expense tracking, income recording, invoicing, and financial reporting. Using a bookkeeping app provides organization, accuracy, and time savings by automating tasks such as data entry and reconciliation.

It also offers valuable financial insights, simplifies invoicing and payment tracking, and provides accessibility through mobile or cloud-based access. Integration with accounting software ensures seamless data syncing. Overall, bookkeeping apps streamline financial management, save time, improve accuracy, and support informed decision-making for businesses and individuals alike.

For more information about bookkeeping apps, check out our article on bookkeeping apps for iOS.

How Was Bookkeeping Traditionally Done?

Traditionally, bookkeeping was a manual and paper-based process. Transactions were recorded by hand in physical ledgers, journals, and other accounting books. Bookkeepers meticulously maintained these records to track financial transactions and ensure accurate financial reporting.

Bookkeepers would start by setting up a general ledger, which served as the primary bookkeeping record. The general ledger included various accounts such as cash, accounts receivable, accounts payable, and different expense and revenue categories. Each account had a designated page or section in the ledger.

When a financial transaction occurred, bookkeepers would manually record the details in the appropriate journal. Journals were specialized books for specific types of transactions, such as cash receipts, cash disbursements, sales, purchases, and general entries. Each entry would include the date, description of the transaction, and the corresponding debit and credit amounts.

After recording transactions in the journals, bookkeepers would transfer the summarized information to the general ledger. This process, known as posting, involved copying the relevant details from the journal entries to the corresponding account in the general ledger. Bookkeepers would carefully ensure the accuracy of the amounts and maintain the balance of debits and credits for each account.

At the end of an accounting period, typically monthly or annually, bookkeepers would prepare financial statements manually. This involved summarizing the information from the general ledger, including the trial balance, income statement, balance sheet, and cash flow statement. Bookkeepers would calculate totals, subtotals, and perform necessary adjustments to ensure accurate financial reporting.

All in all, traditional bookkeeping was a labor-intensive and time-consuming process, heavily reliant on manual calculations and accurate record-keeping. However, advancements in technology and the introduction of computerized accounting systems have significantly streamlined and automated the bookkeeping process in modern times.

Bookkeeping Apps for Children

The suitability of children using bookkeeping apps depends on factors such as their age, understanding of financial concepts, and parental guidance. It is important to consider the following points:

Firstly, children should have a basic understanding of money, budgeting, and financial responsibility before using bookkeeping apps. Younger children may not possess the necessary comprehension for effective usage.

Secondly, parental guidance is crucial. Parents or guardians should provide supervision, explain financial concepts, and help children set goals. Monitoring their usage ensures responsible and appropriate use.

Some bookkeeping apps offer simplified budgeting tools designed specifically for children. These apps focus on teaching basic financial skills, such as saving, tracking allowances, and setting goals. They can be a useful educational tool in a controlled environment.

Financial education should go beyond bookkeeping apps. Teaching children about broader financial concepts like budgeting, saving, investing, and responsible spending is essential. Bookkeeping apps can supplement this education.

Privacy and security are paramount. When considering bookkeeping apps for children, ensure that they have appropriate safeguards in place to protect personal information and transactions.

When it comes to bookkeeping apps specifically designed for children, there are a few options that provide an engaging and educational experience while teaching basic financial concepts. Here are a few notable bookkeeping apps for children:

1. Savings Spree

Savings Spree is an interactive app that teaches children about money management, saving, and spending wisely. It offers various activities and challenges that help kids understand the value of money and make informed financial decisions. The app incorporates real-life scenarios and allows children to set savings goals, track their progress, and learn about budgeting.

2. Bankaroo

Bankaroo is a virtual bank app designed for children to learn about money management in a fun and interactive way. Kids can create their own accounts, set savings goals, track their allowances, and manage their expenses. Bankaroo helps children understand concepts like budgeting, saving, and responsible spending through a simulated banking environment.

3. ChoreCheck

ChoreCheck combines bookkeeping with chore management for children. It allows kids to track their completed chores, set goals, and earn rewards. The app helps children learn about earning money, budgeting, and keeping track of their financial activities. It encourages responsibility and financial literacy through practical tasks and monetary incentives.

4. Green$treets: Unleash the Loot!

Green$treets: Unleash the Loot! is an app that focuses on teaching children about saving, investing, and making environmentally friendly choices. It introduces financial concepts through a narrative-based game where kids help characters in their quest to save their town. The app incorporates budgeting, decision-making, and problem-solving skills while imparting financial knowledge.

These bookkeeping apps for children combine educational content with interactive features to make learning about money fun and engaging. It’s important to note that parental involvement and supervision are crucial to ensure that children understand the concepts and use the apps responsibly.

In summary, the decision to allow children to use bookkeeping apps should consider their readiness, parental involvement, and availability of age-appropriate resources. Striking a balance between practical financial tools and developing a solid foundation of financial literacy and responsibility is crucial.

So without further ado, let’s take a look at the top ten bookkeeping apps for Android.

Best Bookkeeping Apps on Android

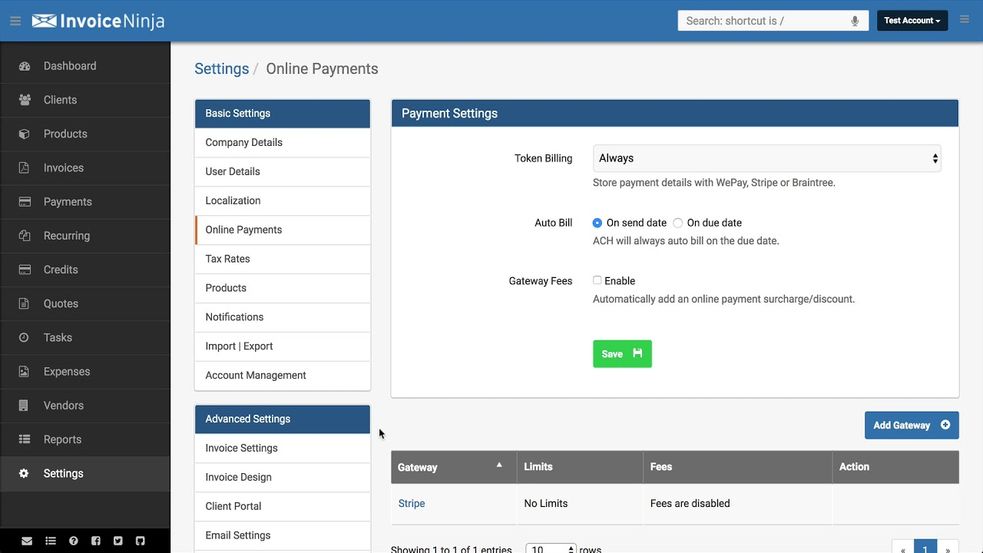

1. Invoice Ninja

Invoice Ninja is a versatile bookkeeping app that offers a range of features for managing invoices and payments. It allows you to generate professional invoices, track expenses, and manage client payments all in one place. With its user-friendly interface, you can easily create and customize invoices, set up recurring billing, and send automated reminders to clients.

Invoice Ninja also provides comprehensive reporting to help you analyze your financial data and track the performance of your business. It offers a convenient solution for freelancers and small businesses looking to streamline their invoicing and payment processes.

2. Money Manager Expense & Budget

Money Manager Expense & Budget is a comprehensive personal finance app that goes beyond basic bookkeeping functions. In addition to expense tracking and income management, it allows you to set up budgets, create savings goals, and track your financial progress over time.

With its intuitive interface, you can categorize transactions, view detailed reports, and visualize your spending patterns through charts and graphs. Money Manager Expense & Budget also offers features like bill reminders, currency conversion, and data backup, making it a versatile tool for managing personal finances effectively.

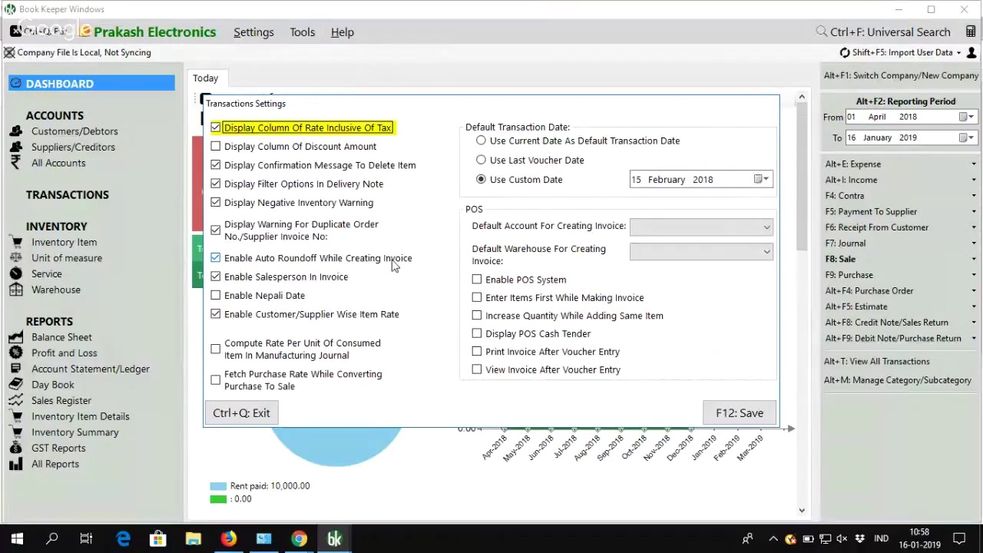

3. Book Keeper

Book Keeper is a user-friendly bookkeeping app designed specifically for small businesses and individuals. It offers a range of features, including expense tracking, invoicing, bank reconciliation, and financial reporting. With its intuitive interface and customizable settings, you can easily record transactions, generate professional invoices, and reconcile your bank statements.

Book Keeper also supports multiple currencies and languages, making it suitable for businesses operating globally. With its robust reporting capabilities, you can gain valuable insights into your financial performance and make informed decisions to drive the success of your business.

4. AndroMoney

AndroMoney is a popular personal finance app with integrated bookkeeping features. It allows you to track your expenses, income, and transfers easily. The app provides a user-friendly interface and supports multiple accounts, making it convenient for managing personal finances.

AndroMoney also offers features like budget planning, customizable categories, and detailed reports to help you gain a clear understanding of your financial situation. With its visual representations and charts, you can monitor your spending habits, identify trends, and make adjustments to achieve your financial goals effectively.

5. Easy Books

Easy Books is a professional bookkeeping app suitable for small businesses and sole traders. It offers a range of features, including expense tracking, invoicing, bank reconciliation, and financial reporting. Easy Books stands out with its focused approach on simplifying the bookkeeping process, making it accessible even for those with limited accounting knowledge.

The app allows you to effortlessly record transactions, generate professional invoices, and reconcile bank statements. With its comprehensive reporting capabilities, you can gain valuable insights into your business’s financial performance and make informed decisions to drive growth and profitability.

6. GnuCash

GnuCash is an open-source accounting app that provides bookkeeping functionality. It offers double-entry accounting, allowing you to track income, expenses, assets, and liabilities accurately. GnuCash provides features such as expense tracking, invoicing, and financial reporting, making it suitable for small businesses and personal finance management.

With its robust reporting capabilities and customizable chart of accounts, you can generate detailed financial reports and analyze your cash flow, balance sheets, and income statements. GnuCash is a powerful tool for those seeking a comprehensive bookkeeping solution with advanced accounting features.

7. My Budget Book

My Budget Book is a personal finance and bookkeeping app designed to help individuals track their expenses, income, and budgets effectively. It offers a simple and intuitive interface, allowing you to easily record transactions, set budget limits, and analyze your spending habits.

The app provides customizable categories, enabling you to tailor the budgeting process to your specific needs. My Budget Book also generates detailed reports, charts, and graphs to visualize your financial data, giving you a clear overview of your financial situation. With its goal-setting features, you can set savings targets and monitor your progress towards achieving them.

8. Monefy

Monefy is a user-friendly personal finance app that includes bookkeeping features. It allows you to track your expenses, income, and transfers seamlessly. With its intuitive design and quick data entry, you can effortlessly record transactions and categorize them for better organization.

Monefy offers visual representations of your spending patterns through charts and graphs, making it easy to understand your financial habits at a glance. The app also provides customizable categories, multiple currency support, and the ability to sync data across devices, ensuring a convenient and personalized experience for managing your personal finances.

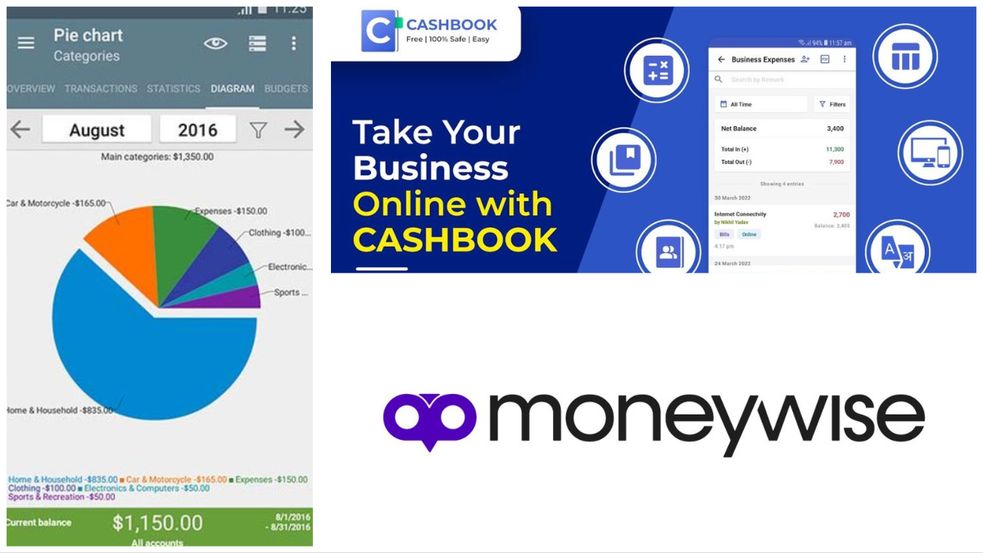

9. MoneyWise

MoneyWise is a budgeting and bookkeeping app focused on expense tracking and financial management. It allows you to record and categorize your expenses, set budget limits, and track your spending against those limits. MoneyWise provides detailed reports and charts to analyze your financial data, helping you identify areas where you can save and make adjustments to your budget.

The app also supports multiple accounts, making it suitable for tracking expenses across different financial sources. With its simplicity and emphasis on budgeting, MoneyWise offers a practical solution for those seeking to gain control over their spending and improve their financial habits.

10. Cashbook – Expense Tracker

Cashbook is an expense tracker and bookkeeping app designed to help you stay on top of your financial transactions. With its user-friendly interface, you can easily record your expenses, income, and transfers. The app allows you to categorize your transactions and add additional details, such as payment methods or notes.

Cashbook also provides features like customizable expense categories, multiple currency support, and the ability to attach photos of receipts for easy reference. With its comprehensive reporting capabilities, you can generate detailed expense reports and gain insights into your spending habits.

Each of these bookkeeping apps offers unique features and functionalities, catering to different needs and preferences. It’s important to evaluate your specific requirements and consider factors such as ease of use, reporting capabilities, budgeting features, and compatibility with your devices before choosing the app that best suits your needs.

In conclusion

The advent of bookkeeping apps on Android has transformed the way we handle our financial affairs. These apps provide a convenient and accessible platform for individuals and businesses to organize, track, and analyze their income, expenses, and budgets. With intuitive interfaces, customizable features, and powerful reporting capabilities, Android users can harness the benefits of bookkeeping apps to achieve greater financial control and success.

Gone are the days of manual record-keeping and cumbersome spreadsheets. Bookkeeping apps on Android offer automation, real-time updates, and seamless synchronization across devices, ensuring that financial data is readily available and up to date. From tracking daily expenses to generating professional invoices, these apps empower users to stay on top of their financial responsibilities with ease.

However, it’s important to choose a bookkeeping app that aligns with your specific needs, offers strong security measures, and provides reliable support. Consider factors such as user-friendliness, compatibility, and the availability of features that are essential for your financial management requirements.

With bookkeeping apps readily accessible on Android devices, anyone can become a proficient financial manager, gaining insights into their spending habits, making informed decisions, and working towards their financial goals with confidence. Embrace the power of bookkeeping apps and embark on a journey towards financial well-being and success.