Car insurance is a necessity for drivers in the USA, but it can also be a hassle to manage. You may have to deal with paper documents, phone calls, and long wait times when you need to access your policy, pay your bill, or file a claim. Fortunately, technology has made it easier for you to handle your car insurance needs with just a few taps on your smartphone. Many car insurance companies have developed mobile apps that offer various features and benefits to their customers. But which ones are the best?

In this article, we will rank the top 10 car insurance apps for USA based on customer ratings, expert reviews, and app functionality. We will also highlight the pros and cons of each app and what makes them stand out from the rest. Here are our picks for the best car insurance apps for USA in 2023:

10. Nationwide

Nationwide is one of the largest and most trusted car insurance companies in the USA, and its mobile app reflects its reputation. The Nationwide app allows you to view your policy details, pay your bill, request roadside assistance, and file and track claims. You can also access your digital ID card, find nearby agents and repair shops, and get driving tips and safety alerts.

The Nationwide app has a 4.7-star rating on Google Play and a 4.8-star rating on the App Store. Customers praise the app for its ease of use, convenience, and customer service. However, some users complain about technical issues, such as login problems, crashes, and slow loading.

One of the main advantages of the Nationwide app is its simple and user-friendly interface. The app has a clear and intuitive layout that makes it easy to navigate and find what you need. You can access all the essential features from the home screen or the menu bar at the bottom. The app also has a dark mode option that reduces eye strain and battery consumption.

Another benefit of the Nationwide app is its comprehensive policy management and claims features. The app allows you to view your coverage details, deductibles, discounts, and payment history. You can also pay your bill using various methods, such as credit card, debit card, bank account, or PayPal. If you need roadside assistance, you can request it from the app and track the status of your service. You can also file and track claims using the app’s photo and video tools. You can upload photos or videos of the damage, get an estimate, schedule an inspection or repair, and check the progress of your claim.

A third advantage of the Nationwide app is its helpful driving tools and resources. The app provides you with useful information and alerts to improve your driving safety and save money on your car insurance. For example, you can use the SmartRide feature to track your driving habits and earn discounts based on your performance. You can also use the Driving History feature to review your past trips and see how you can improve your driving skills. The app also sends you safety alerts when there are severe weather conditions or traffic incidents in your area.

However, the Nationwide app also has some drawbacks that may affect your user experience. One of the main disadvantages of the Nationwide app is its occasional bugs and glitches. Some users report that they have trouble logging in to the app or that the app crashes or freezes when they try to use certain features. Some users also say that the app takes too long to load or update information.

Another drawback of the Nationwide app is its limited customization options. The app does not allow you to make changes to your policy or coverage through the app. You have to call or visit an agent if you want to modify your policy or add or remove drivers or vehicles. The app also does not let you choose your preferred language or adjust your notification settings.

Pros:

- Simple and user-friendly interface

- Comprehensive policy management and claims features

- Helpful driving tools and resources

Cons:

- Occasional bugs and glitches

- Limited customization options

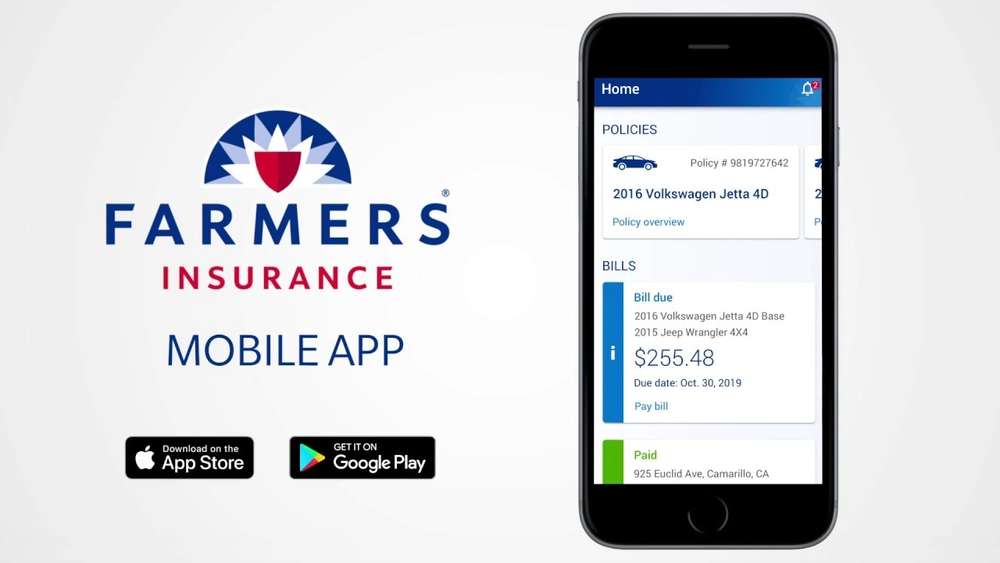

9. Farmers

Farmers is another well-known car insurance company that offers a reliable and functional mobile app. The Farmers app lets you view your policy information, pay your premium, access your digital ID card, and file and track claims. You can also request roadside assistance, contact your agent, find nearby services, and get discounts on shopping and dining.

The Farmers app has a 4.8-star rating on Google Play and a 4.9-star rating on the App Store. Customers appreciate the app for its simplicity, speed, and security. However, some users report issues with logging in, updating information, and receiving notifications.

One of the main advantages of the Farmers app is its fast and secure payment system. The app allows you to pay your bill using various methods, such as credit card, debit card, bank account, or Apple Pay. You can also set up automatic payments or schedule future payments to avoid late fees or penalties. The app uses encryption and biometric authentication to protect your personal and financial information.

Another benefit of the Farmers app is its convenient claims process. The app allows you to file and track claims using the app’s photo and video tools. You can upload photos or videos of the damage, get an estimate, schedule an inspection or repair, and check the status of your claim. You can also chat with a claims representative or call the 24/7 claims hotline if you need assistance.

A third advantage of the Farmers app is its exclusive perks and rewards. The app provides you with access to the Farmers Rewards Visa Card, which lets you earn points for every dollar you spend on your car insurance or other purchases. You can redeem your points for cash back, gift cards, travel, or merchandise. The app also gives you access to the Farmers Circle of Savings, which offers you discounts on various products and services, such as restaurants, hotels, car rentals, and more.

However, the Farmers app also has some drawbacks that may affect your user experience. One of the main disadvantages of the Farmers app is its login difficulties. Some users report that they have trouble logging in to the app or that they get logged out frequently. Some users also say that they have to enter their username and password every time they open the app, which can be annoying and time-consuming.

Another drawback of the Farmers app is its outdated design. The app has a bland and boring interface that lacks visual appeal and creativity. The app also has a cluttered and confusing layout that makes it hard to navigate and find what you need. The app could use a makeover to make it more attractive and user-friendly.

Pros:

- Fast and secure payment system

- Convenient claims process

- Exclusive perks and rewards

Cons:

- Login difficulties

- Outdated design

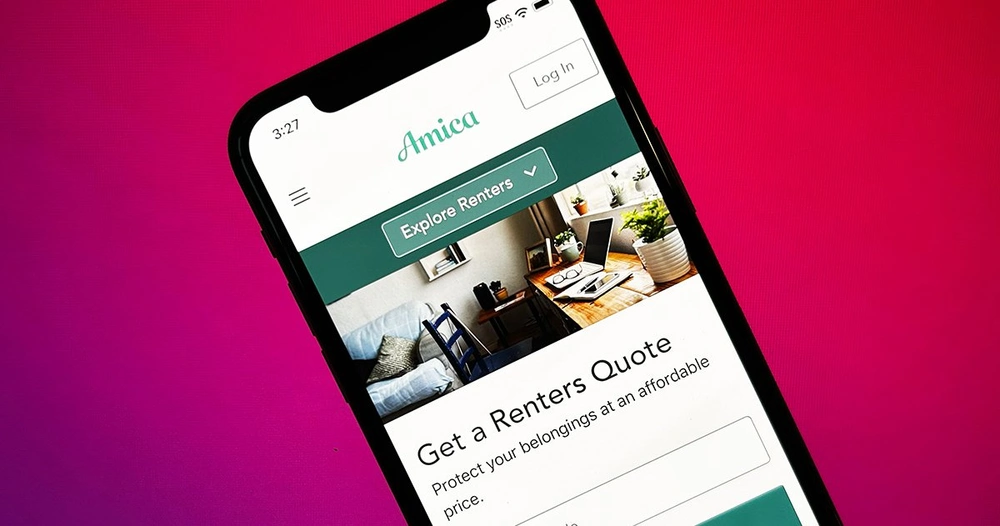

8. Amica

Amica is a smaller but highly rated car insurance company that prides itself on its customer satisfaction. The Amica app allows you to manage your policy, pay your bill, access your digital ID card, and file and track claims. You can also request roadside assistance, contact your agent, find repair shops, and get quotes for other insurance products.

The Amica app has a 4.8-star rating on Google Play and a 4.9-star rating on the App Store. Customers love the app for its simplicity, efficiency, and helpfulness. However, some users wish the app had more features, such as fingerprint login, policy changes, and document uploads.

One of the main advantages of the Amica app is its high customer satisfaction. The app allows you to communicate with your agent or customer service representative easily and quickly. You can call, email, or chat with them from the app and get answers to your questions or concerns. You can also rate your experience and provide feedback to help them improve their service.

Another benefit of the Amica app is its easy policy management and claims filing. The app allows you to view your coverage details, deductibles, discounts, and payment history. You can also pay your bill using various methods, such as credit card, debit card, bank account, or Apple Pay. If you need roadside assistance, you can request it from the app and track the status of your service. You can also file and track claims using the app’s photo and video tools. You can upload photos or videos of the damage, get an estimate, schedule an inspection or repair, and check the progress of your claim.

A third advantage of the Amica app is its multiple insurance options. The app allows you to get quotes for other insurance products that Amica offers, such as home, renters, life, umbrella, motorcycle, boat, and more. You can also bundle your policies to save money and simplify your insurance management.

However, the Amica app also has some drawbacks that may affect your user experience. One of the main disadvantages of the Amica app is its lack of advanced features. The app does not allow you to make changes to your policy or coverage through the app. You have to call or visit an agent if you want to modify your policy or add or remove drivers or vehicles. The app also does not let you use fingerprint login or face ID to access the app securely and conveniently. The app also does not let you upload documents such as proof of insurance or driver’s license to verify your identity or information.

Another drawback of the Amica app is its limited coverage area. The app is only available in certain states in the USA, such as Alabama, Arizona, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, Washington, and Wisconsin.

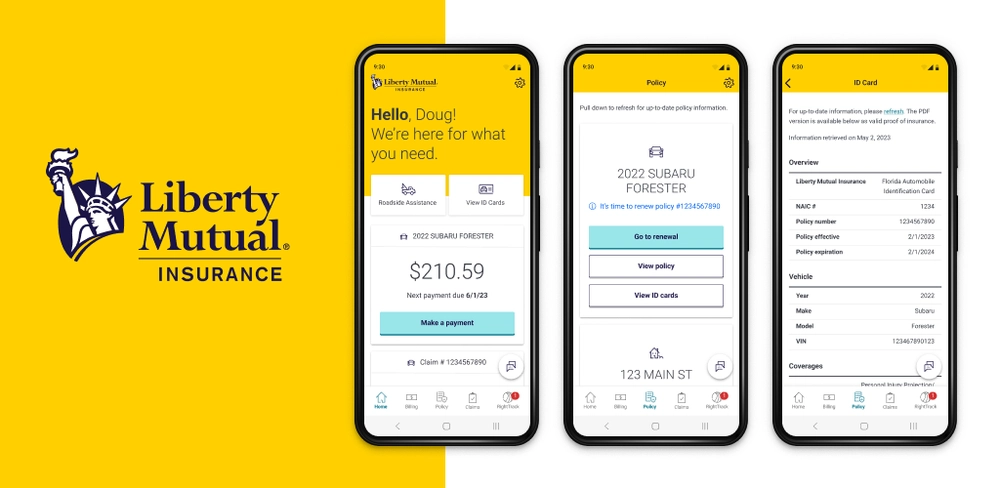

7. Liberty Mutual

Liberty Mutual is a popular car insurance company that offers a variety of coverage options and discounts. The Liberty Mutual app enables you to view your policy details, pay your bill, access your digital ID card, and file and track claims. You can also request roadside assistance, contact your agent or customer service representative, and get quotes for other insurance products.

The Liberty Mutual app has a 4.8-star rating on Google Play and a 5-star rating on the App Store. Customers rave about the app for its functionality, convenience, and innovation. However, some users experience issues with logging in, updating information, and receiving notifications.

One of the main advantages of the Liberty Mutual app is its flexible coverage options and discounts. The app allows you to customize your policy and coverage to suit your needs and budget. You can choose from various types of coverage, such as liability, collision, comprehensive, medical payments, uninsured/underinsured motorist, rental reimbursement, roadside assistance, and more. You can also adjust your deductibles and limits to change your premium amount. The app also offers you various discounts, such as safe driver, multi-policy, multi-car, online purchase, pay in full, paperless, and more.

Another benefit of the Liberty Mutual app is its comprehensive policy management and claims features. The app allows you to view your coverage details, deductibles, discounts, and payment history. You can also pay your bill using various methods, such as credit card, debit card, bank account, or Apple Pay. If you need roadside assistance, you can request it from the app and track the status of your service. You can also file and track claims using the app’s photo and video tools. You can upload photos or videos of the damage, get an estimate, schedule an inspection or repair, and check the progress of your claim.

A third advantage of the Liberty Mutual app is its innovative tools such as photo estimates and coverage advisor. The app allows you to use your smartphone camera to take photos of the damage and get an instant estimate of the repair cost. You can also use the coverage advisor feature to answer a few questions and get personalized recommendations for your optimal coverage level.

However, the Liberty Mutual app also has some drawbacks that may affect your user experience. One of the main disadvantages of the Liberty Mutual app is its login problems. Some users report that they have trouble logging in to the app or that they get logged out frequently. Some users also say that they have to enter their username and password every time they open the app, which can be annoying and time-consuming.

Another drawback of the Liberty Mutual app is its notification errors. Some users report that they do not receive notifications or reminders for their bill payments or claims updates. Some users also say that they receive duplicate or irrelevant notifications that clutter their inbox.

Pros:

- Flexible coverage options and discounts

- Comprehensive policy management and claims features

- Innovative tools such as photo estimates and coverage advisor

Cons:

- Login problems

- Notification errors

6. Progressive

Progressive is one of the most recognizable car insurance companies in the USA, and its mobile app is equally impressive. The Progressive app allows you to view your policy information, pay your bill, access your digital ID card, and file and track claims. You can also request roadside assistance, contact your agent or customer service representative, and get quotes for other insurance products.

The Progressive app has a 4.8-star rating on Google Play and a 5-star rating on the App Store. Customers compliment the app for its design, performance, and reliability. However, some users encounter issues with logging in, updating information, and using certain features.

One of the main advantages of the Progressive app is its sleek and modern interface. The app has a colorful and attractive design that makes it appealing and fun to use. The app also has a clear and intuitive layout that makes it easy to navigate and find what you need. You can access all the essential features from the home screen or the menu bar at the bottom. The app also has a dark mode option that reduces eye strain and battery consumption.

Another benefit of the Progressive app is its smooth and fast performance. The app works seamlessly and quickly without any lag or delay. You can view your policy details, pay your bill, access your digital ID card, and file and track claims in seconds. The app also uses encryption and biometric authentication to protect your personal and financial information.

A third advantage of the Progressive app is its reliable and consistent service. The app provides you with access to 24/7 customer support and roadside assistance. You can call, email, or chat with a representative from the app and get answers to your questions or concerns. You can also request roadside assistance from the app and track the status of your service. The app also sends you timely notifications and reminders for your bill payments and claims updates.

However, the Progressive app also has some drawbacks that may affect your user experience. One of the main disadvantages of the Progressive app is its login difficulties. Some users report that they have trouble logging in to the app or that they get logged out frequently. Some users also say that they have to enter their username and password every time they open the app, which can be annoying and time-consuming.

Another drawback of the Progressive app is its update errors. Some users report that they encounter problems with updating their information or using certain features after the app updates. Some users also say that the app updates too frequently or without their consent, which can be inconvenient and disruptive.

Pros:

- Sleek and modern interface

- Smooth and fast performance

- Reliable and consistent service

Cons:

- Login difficulties

- Update errors

5. State Farm

State Farm is the largest car insurance company in the USA, and its mobile app is one of the best in the industry. The State Farm app lets you view your policy details, pay your bill, access your digital ID card, and file and track claims. You can also request roadside assistance, contact your agent or customer service representative, and get quotes for other insurance products.

The State Farm app has a 4.8-star rating on Google Play and a 5-star rating on the App Store. Customers admire the app for its functionality, convenience, and security. However, some users report issues with logging in, updating information, and receiving notifications.

One of the main advantages of the State Farm app is its full-featured and user-friendly interface. The app has a comprehensive and intuitive layout that makes it easy to navigate and find what you need. You can access all the essential features from the home screen or the menu bar at the bottom. The app also has a dark mode option that reduces eye strain and battery consumption.

Another benefit of the State Farm app is its convenient and secure payment system. The app allows you to pay your bill using various methods, such as credit card, debit card, bank account, or Apple Pay. You can also set up automatic payments or schedule future payments to avoid late fees or penalties. The app uses encryption and biometric authentication to protect your personal and financial information.

A third advantage of the State Farm app is its helpful and responsive customer service. The app provides you with access to 24/7 customer support and roadside assistance. You can call, email, or chat with a representative from the app and get answers to your questions or concerns. You can also request roadside assistance from the app and track the status of your service. The app also sends you timely notifications and reminders for your bill payments and claims updates.

However, the State Farm app also has some drawbacks that may affect your user experience. One of the main disadvantages of the State Farm app is its login problems. Some users report that they have trouble logging in to the app or that they get logged out frequently. Some users also say that they have to enter their username and password every time they open the app, which can be annoying and time-consuming.

Another drawback of the State Farm app is its notification errors. Some users report that they do not receive notifications or reminders for their bill payments or claims updates. Some users also say that they receive duplicate or irrelevant notifications that clutter their inbox.

Pros:

- Full-featured and user-friendly interface

- Convenient and secure payment system

- Helpful and responsive customer service

Cons:

- Login problems

- Notification errors

4. Allstate

Allstate is a leading car insurance company that offers a range of coverage options and discounts. The Allstate app enables you to view your policy information, pay your bill, access your digital ID card, and file and track claims. You can also request roadside assistance, contact your agent or customer service representative, and get quotes for other insurance products.

The Allstate app has a 4.8-star rating on Google Play and a 5-star rating on the App Store. Customers appreciate the app for its ease of use, convenience, and customer service. However, some users complain about technical issues, such as login problems, crashes, and slow loading.

One of the main advantages of the Allstate app is its simple and user-friendly interface. The app has a clear and intuitive layout that makes it easy to navigate and find what you need. You can access all the essential features from the home screen or the menu bar at the bottom. The app also has a dark mode option that reduces eye strain and battery consumption.

Another benefit of the Allstate app is its comprehensive policy management and claims features. The app allows you to view your coverage details, deductibles, discounts, and payment history. You can also pay your bill using various methods, such as credit card, debit card, bank account, or Apple Pay. If you need roadside assistance, you can request it from the app

and track the status of your service. You can also file and track claims using the app’s photo and video tools. You can upload photos or videos of the damage, get an estimate, schedule an inspection or repair, and check the progress of your claim.

A third advantage of the Allstate app is its helpful and responsive customer service. The app provides you with access to 24/7 customer support and roadside assistance. You can call, email, or chat with a representative from the app and get answers to your questions or concerns. You can also rate your experience and provide feedback to help them improve their service.

However, the Allstate app also has some drawbacks that may affect your user experience. One of the main disadvantages of the Allstate app is its occasional bugs and glitches. Some users report that they have trouble logging in to the app or that the app crashes or freezes when they try to use certain features. Some users also say that the app takes too long to load or update information.

Another drawback of the Allstate app is its limited customization options. The app does not allow you to make changes to your policy or coverage through the app. You have to call or visit an agent if you want to modify your policy or add or remove drivers or vehicles. The app also does not let you choose your preferred language or adjust your notification settings.

Pros:

- Simple and user-friendly interface

- Comprehensive policy management and claims features

- Helpful and responsive customer service

Cons:

- Occasional bugs and glitches

- Limited customization options

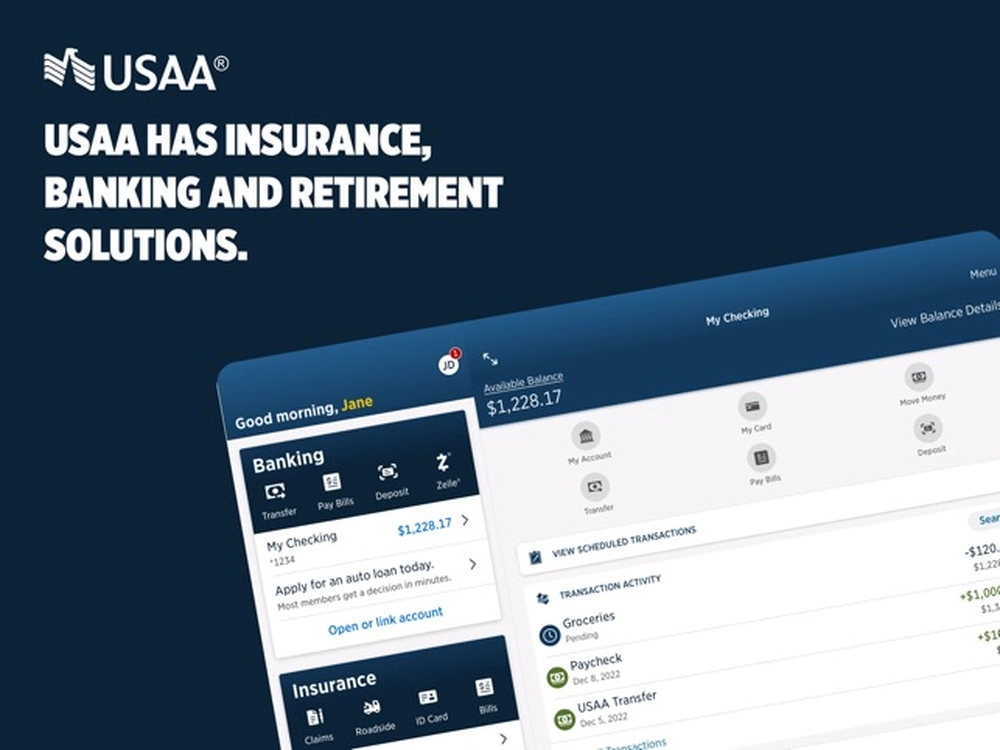

3. USAA

USAA is a top-rated car insurance company that caters to military members and their families. The USAA app allows you to view your policy information, pay your bill, access your digital ID card, and file and track claims. You can also request roadside assistance, contact your agent or customer service representative, and get quotes for other insurance products.

The USAA app has a 4.8-star rating on Google Play and a 5-star rating on the App Store. Customers love the app for its simplicity, speed, and security. However, some users report issues with logging in, updating information, and using certain features.

One of the main advantages of the USAA app is its fast and secure payment system. The app allows you to pay your bill using various methods, such as credit card, debit card, bank account, or Apple Pay. You can also set up automatic payments or schedule future payments to avoid late fees or penalties. The app uses encryption and biometric authentication to protect your personal and financial information.

Another benefit of the USAA app is its convenient claims process. The app allows you to file and track claims using the app’s photo and video tools. You can upload photos or videos of the damage, get an estimate, schedule an inspection or repair, and check the status of your claim. You can also chat with a claims representative or call the 24/7 claims hotline if you need assistance.

A third advantage of the USAA app is its exclusive perks and rewards. The app provides you with access to the USAA Rewards Program, which lets you earn points for every dollar you spend on your car insurance or other purchases. You can redeem your points for cash back, gift cards, travel, or merchandise. The app also gives you access to the USAA MemberShop, which offers you discounts on various products and services, such as restaurants, hotels, car rentals, and more.

However, the USAA app also has some drawbacks that may affect your user experience. One of the main disadvantages of the USAA app is its login difficulties. Some users report that they have trouble logging in to the app or that they get logged out frequently. Some users also say that they have to enter their username and password every time they open the app, which can be annoying and time-consuming.

Another drawback of the USAA app is its outdated design. The app has a bland and boring interface that lacks visual appeal and creativity. The app also has a cluttered and confusing layout that makes it hard to navigate and find what you need. The app could use a makeover to make it more attractive and user-friendly.

Pros:

- Fast and secure payment system

- Convenient claims process

- Exclusive perks and rewards

Cons:

- Login difficulties

- Outdated design

2. Geico

Geico is one of the most popular car insurance companies in the USA, and its mobile app is one of the most advanced and innovative in the industry. The Geico app lets you view your policy information, pay your bill, access your digital ID card, and file and track claims. You can also request roadside assistance, contact your agent or customer service representative, and get quotes for other insurance products.

The Geico app has a 4.8-star rating on Google Play and a 5-star rating on the App Store. Customers rave about the app for its functionality, convenience, and innovation. However, some users experience issues with logging in, updating information, and receiving notifications.

One of the main advantages of the Geico app is its flexible coverage options and discounts. The app allows you to customize your policy and coverage to suit your needs and budget. You can choose from various types of coverage, such as liability, collision, comprehensive, medical payments, uninsured/underinsured motorist, rental reimbursement, roadside assistance, and more. You can also adjust your deductibles and limits to change your premium amount. The app also offers you various discounts, such as safe driver, multi-policy, multi-car, online purchase, pay in full, paperless, and more.

Another benefit of the Geico app is its comprehensive policy management and claims features. The app allows you to view your coverage details, deductibles, discounts, and payment history. You can also pay your bill using various methods, such as credit card, debit card, bank account, or Apple Pay. If you need roadside assistance, you can request it from the app and track the status of your service. You can also file and track claims using the app’s photo and video tools. You can upload photos or videos of the damage, get an estimate, schedule an inspection or repair, and check the progress of your claim.

A third advantage of the Geico app is its innovative tools such as photo estimates and coverage advisor. The app allows you to use your smartphone camera to take photos of the damage and get an instant estimate of the repair cost. You can also use the coverage advisor feature to answer a few questions and get personalized recommendations for your optimal coverage level.

However, the Geico app also has some drawbacks that may affect your user experience. One of the main disadvantages of the Geico app is its login problems. Some users report that they have trouble logging in to the app or that they get logged out frequently. Some users also say that they have to enter their username and password every time they open the app, which can be annoying and time-consuming.

Another drawback of the Geico app is its notification errors. Some users report that they do not receive notifications or reminders for their bill payments or claims updates. Some users also say that they receive duplicate or irrelevant notifications that clutter their inbox.

Pros:

- Flexible coverage options and discounts

- Comprehensive policy management and claims features

- Innovative tools such as photo estimates and coverage advisor

Cons:

- Login problems

- Notification errors

1. Jerry

Jerry is not a car insurance company, but a car insurance comparison app that helps you find the best coverage at the lowest price. Jerry compares quotes from over 50 top-rated insurers in minutes, and handles all the paperwork for you. You can also manage your policy, pay your bill, access your digital ID card, and file and track claims through Jerry.

Jerry has a 4.9-star rating on Google Play and a 5-star rating on the App Store. Customers praise Jerry for its simplicity, efficiency, and savings. However, some users wish Jerry had more features, such as roadside assistance, contact options, and document uploads.

One of the main advantages of Jerry is its easy and fast quote comparison. Jerry allows you to compare quotes from multiple car insurance companies in minutes, without filling out long forms or providing personal information. You just need to enter your car details and driving history, and Jerry will show you the best offers from different insurers. You can also filter and sort the quotes by price, coverage, rating, or customer reviews.

Another benefit of Jerry is its hassle-free switching and renewal. Jerry handles all the paperwork and phone calls for you when you switch or renew your car insurance policy. You just need to choose your preferred policy and confirm your payment details, and Jerry will take care of the rest. Jerry will also cancel your old policy for you and send you a confirmation email.

A third advantage of Jerry is its significant savings on premiums. Jerry helps you save money on your car insurance by finding you the lowest rates and discounts available. Jerry claims that it can save you an average of $879 per year on your car insurance premium. Jerry also monitors your policy every six months and notifies you if there is a better deal for you.

However, Jerry also has some drawbacks that may affect your user experience. One of the main disadvantages of Jerry is its lack of advanced features. Jerry does not offer roadside assistance, contact options, or document uploads through its app. You have to use other apps or services if you need these features. Jerry also does not let you make changes to your policy or coverage through the app. You have to call or email Jerry if you want to modify your policy or add or remove drivers or vehicles.

Another drawback of Jerry is its limited coverage area. Jerry is only available in certain states in the USA, such as Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts and Michigan.