Axie Infinity: online games where people earn as they play are transforming gaming

What is Axie Infinity?

The Play-to-Earn NFT Game Taking Crypto By Storm

Buy, battle, breed adorable monsters… and profit? That’s the hook behind Axie Infinity, the hottest crypto game on the market right now.

The ultimate point of playing video games has always been to have fun. Whether it’s Space Invaders or Sonic or Red Dead Redemption, you hit the start button and do your thing until game over – and then you probably wipe the sweat off your hands and do it again.

But a new class of games is emerging where playing is an investment opportunity – and even potentially a way to earn a living. So-called play-to-earn games like Axie Infinity and The Sandbox have been exploding in popularity recently.

What they have in common with many previous classics is that they include complex economic ecosystems. In the 1980s blockbuster Elite, for example, players travelled from planet to planet, trying to increase their credits by buying and selling things like weapons and commodities. Or in life-simulation franchise The Sims, players buy everything from pizzas to houses with Simoleons.

But in these older games, the in-game currency had no value in the real world. There have also been games like World of Warcraft where a grey market for exchanging in-game items and characters grew up around them. But play-to-earn games take this to a whole new level. So how do these games work and

where are they heading?

To infinity

The leader in this new space is Axie Infinity, a Pokémon-style game created by the Vietnamese developer Sky Mavis. It has some 350,000 daily active users, about 40% of whom are in the Philippines, with Venezuela and the US the next two biggest markets.

The game revolves around cute furry creatures called Axies, which players breed, acquire, train, use to complete challenges, and do battle with online. The object of the game is to obtain small love potions (SLPs), which can be used to breed new Axies that can then be deployed within the game.

SLPs double as cryptocurrencies that can be bought and sold on a crypto exchange. Top players are reportedly earning SLP1,500 (US$435/£317) per day from their Axies, though the price of SLPs against the US dollar is constantly changing. It has broadly been rising since 2020, so there is an argument for hanging on to them – or alternatively, selling while the going is good.

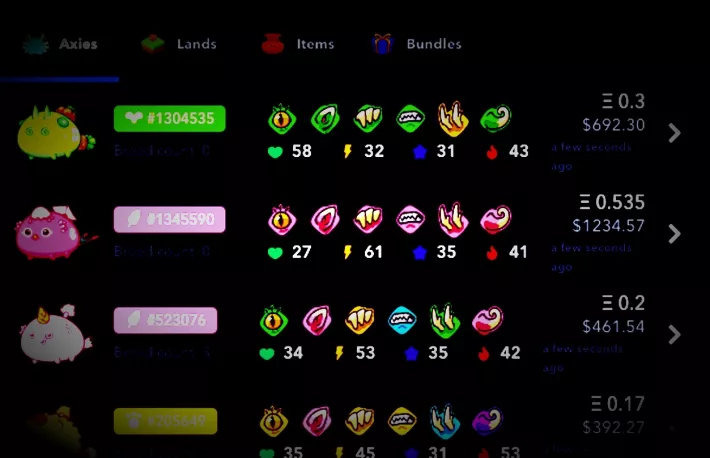

Axies themselves can be traded in real life in the likes of the Axie Marketplace as NFTs (non-fungible tokens). NFTs are digital collectables that exist on online ledgers known as blockchains, and are better known for recently taking the art world by storm.

As well as Axies, other in-game items like real estate, flowers, barrels and lamps are all tradeable as NFTs too. These are all bought and sold using ethereum, which is the second biggest cryptocurrency after bitcoin.

This is a welcome improvement on predecessors such as World of Warcraft where trading of gold and in-game assets took place in unaffiliated auction sites, and was grounds for being banned from the game for a long time. By introducing a dedicated marketplace, NFTs and a blockchain, the trading around Axie Infinity and similar games is more secure and means that players actually own the items in question.

To get started on Axie Infinity, players need to buy (or borrow) three Axies. They are available from US$190 (£138), though the current average is about US$350, and higher level, rare or mystic Axies can sell for a lot more.

The most expensive ever Axie, a triple mystic called Angel, sold for ETH300 in late 2020, which was around US$120,000 at the time. Meanwhile, a chunk of in-game real estate went for US$1.5 million earlier in 2021. Monthly trading volumes for all Axie Infinity NFTs currently stand at US$170 million.

Finally, there is another cryptocurrency associated with this game called the Axie Infinity shard (AXS). Investors in AXS have a vote in the governance of the game’s ecosystem, and can also use it to get a share of the community treasury. AXS has also seen an impressive rise recently, up about sixfold in recent weeks. It is the largest gaming cryptocurrency on the market.

…And beyond

Besides Axie Infinity, CryptoKitties is another play-to-earn game that has built up a substantial following. In that game, players buy, breed and trade digital cats using ethereum. Again, these cats are NFTs, which generate wealth not just for the developers but also the player community. The most expensive CryptoKitty sold to date, which was called Dragon, went for ETH600 (around US$170,000 at the time).

Apart from generating real income for players, play-to-earn games also create communities where gamers and creators can meet, share wisdom, and do deals with one another. A good example of this is The Sandbox, a game in the same genre as Minecraft where players build things and exchange with them with one another as NFTs.

This discreet economy is driven by its own cryptocurrency, SAND. One way to make SAND is to sell parcels of digital real estate known as LAND, which players can purchase for their shopfront as a way of sharing experiences with visitors to the world. In February alone, the game announced that a record 2,352 plots of LAND had been sold for a combined US$2.8 million.

With such levels of interest, major brands are seeing the potential to take a piece of this expanding metaverse. For example, The Walking Dead will soon be opening its doors on the platform, allowing players to enter a zombie world within the game, in what Sandbox says is a step towards a “virtual attraction park”. Brands like these are presumably likely to draw a more mainstream audience to the platform.

Now that games like these are possible, it seems likely that they are here to stay. Many games have sustained online communities in the past, but by adding the ability to make financial gains, play-to-earn games will potentially lead to even more successful communities in future. If this corner of gaming is new to you, it’s time to start watching closely.

also read :

Elon Musk’s Twitter profile picture change sends Dogecoin soaring

Tesla has not sold any Bitcoin ! Elon Musk : We’re not selling any Bitcoin

What is Axie Infinity ?

The Play-to-Earn NFT Game Taking Crypto By Storm

Buy, battle, breed adorable monsters… and profit? That’s the hook behind Axie Infinity, the hottest crypto game on the market right now.

Axie Infinity is a blockchain-based game in which players purchase NFTs of cute monsters and then battle them against each other.

Players can earn SLP tokens during gameplay and trade those for money at an exchange. It’s fueling a “play-to-earn” movement around the game.

Non-fungible token (NFT) crypto collectibles like artwork and videos exploded in popularity in early 2021, but several blockchain-based video games had already been building in the space before most people took notice.

When NFTs hit the mainstream, the promising crypto game Axie Infinity by indie studio Sky Mavis took off. And when the wider NFT market cooled a bit after all of that hype… well, Axie Infinity got even bigger.

Axie Infinity is inspired by Nintendo’s beloved Pokémon series, and sees you collect and pit adorable monsters against each other in cartoonish combat. Getting started isn’t simple or cheap, however, and there’s a vastly larger upfront investment needed than your average PlayStation or Xbox game. The upside, however, is that you own your Axie NFTs and can resell them, plus its “play-to-earn” approach rewards you with crypto tokens that can be exchanged for money.

It’s a bold new vision for gaming—and it’s catching on. Here’s how to get started.

What is Axie Infinity?

Axie Infinity is a monster-battling game where you pit teams of cute monsters called Axies against each other in battles.

The game runs on the Ethereum blockchain with the help of Ronin, a sidechain that helps minimize fees and transaction delays. It’s primarily focused on turn-based battles, either against computer-controlled Axie teams or live opponents over the Internet.

In-game items are represented by NFTs, or non-fungible tokens. These cryptographically unique tokens can be linked with digital content; in Axie Infinity’s case, the Axies and land plots that populate the game. Unlike conventional in-game items, the NFT confers ownership on the buyer; you can trade Axies on the game’s marketplace for real money.

You can also breed Axies, which lets you build potentially more powerful teams and yields additional NFTs to sell on the marketplace. Some Axie NFTs have sold for as much as 300 ETH apiece, or more than $600,000 as of this writing.

How does Axie Infinity work?

As mentioned, Axie Infinity is built entirely around NFT items—and right now, there’s no way to play unless you buy the three Axie NFTs needed to create your first team.

They can be purchased from the official Axie marketplace via your Ronin wallet, which you’ll connect to the game. You can play on PC, Mac, Android, or iOS and take your Axies into battle to win rewards.

My son might be able to acquire his school at this point. https://t.co/VcbY3RmDr1

— Gabby Dizon (@gabusch) July 23, 2021

What’s so special about it?

Axie Infinity takes the fun and alluring premise of Pokémon and adds the element of ownership into the mix. These Axies belong to you and yield tangible rewards: Smooth Love Potion (SLP) crypto tokens that can be exchanged for money. The upfront costs will be a major roadblock for many players, but it’s a game that rewards players the more time and effort that they put into it.

“Play-to-earn” might sound like a marketing phrase or a gimmicky hook, but we’re already seeing evidence of a player-owned economy taking shape around the game.

For example, there are thousands of “Axie scholars” through programs like Yield Guild Games and others, in which Axie owners loan their NFTs to other players to use and earn with. The profits are divided amongst the parties, and in countries like the Philippines and Indonesia, people are playing Axie to support their families. Whether that proves to be a sustainable model remains to be seen, but it’s a potentially powerful and revolutionary idea that is already being put into practice.

How to get started with Axie Infinity

Here’s the hang-up: you will need three Axie NFTs to start playing Axie Infinity, and as of this writing, the most affordable Axies available on the marketplace are about $225-$250 apiece. You might spend $700 or more to build a starter team. That’s more than the price of a PlayStation 5 or Xbox Series X console, let alone a game. Keep in mind that your Axies are investments and can be resold, plus they generate rewards through gameplay.

Now that Axie Infinity has migrated assets from Ethereum to its Ronin sidechain, you will need to create a Ronin wallet and have an Ethereum wallet (like MetaMask) as well. Once you have a Ronin wallet set up, you can use the Ronin bridge to transfer ETH over to Ronin, where it becomes WETH (Wrapped ETH). You can then use this to purchase Axies.

Create an account on the Axie Infinity website and download the game to your PC or Mac. You can download an Android APK to install on a smartphone or tablet, as well. The game has also been available for iOS via a beta release through Apple’s TestFlight program, but is currently unavailable as of this writing.

Whichever version you choose, you’ll need to pair your Ronin wallet to your account, and then sync your Axies from the wallet to the game to start playing.

What is the AXS token?

Axis Infinity Shard (AXS) is the native governance token of Axie Infinity. Currently, you can use AXS to pay for breeding fees. In the future, AXS holders will be able to vote on decisions regarding the game and its future development, as well as stake AXS tokens to earn rewards within the game.

Over time, Axie Infinity plans to gradually shift into a decentralized autonomous organization (DAO) to allow for community governance.

Did you know?

You can’t even use Axie’s land in gameplay yet, but it’s in demand: a set of nine land plots sold for about $1.5 million in February 2021.

Where can you buy AXS?

AXS is available from cryptocurrency exchanges such as Binance, FTX, and Huobi Global, although it is not currently sold by Coinbase or Binance.US, for example. Decentralized exchanges like Uniswap and SushiSwap offer it, however.

Here’s how you can purchase AXS from Uniswap. You will need a crypto wallet with ETH or another Ethereum-based ERC20 token to trade at Uniswap. If you need ETH, you can purchase it with fiat money at Coinbase or Binance and then transfer it to your wallet.

Connect your wallet at Uniswap, select AXS from the list, and then choose which asset you want to swap for it. Enter the amount you want to trade and Uniswap will tell you how much AXS you will receive in return. If the numbers square up to your liking, click “Swap” and the transaction will go through.

?

Mystic Madness! https://t.co/LaVcKM03fQ

— Axie Infinity (@AxieInfinity) July 24, 2021

Axie Infinity Token Price Doubles in Two Days !

The Axie Infinity platform’s revenue could exceed $1 billion this year, based on a Delphi Digital projection.

The governance token of the Axie Infinity platform, AXS, has doubled in price since Wednesday.

As of Friday the AXS token was trading at a new all-time high price of $30, implying a year-to-date gain of over 5,700%.

Axie Infinity is a blockchain-based trading and battling game that allows players to collect, breed, raise, battle and trade token-based creatures known as “axies,” which are digitized as their own NFTs.

According to research from TheTie, Axie Infinity has quickly become one of the highest-revenue projects on the Ethereum blockchain. Axie Infinity’s revenue is up over 17,000% since April 1 as user growth accelerated dramatically during the second quarter.

According to research boutique firm Delphi Digital, Axie Infinity is projected to end the year with total revenue of over $1 billion. (Delphi has disclosed that it has invested in the AXS tokens and that some members of its team might also hold AXS and Axie NFTs.)

The protocol earns revenue by charging a 4.25% fee when players buy and sell Axie NFTs in its marketplace and collecting fees for breeding axies to create new ones. The fees are paid in the form of Axie Infinity Shards (AXS) and Smooth Love Potion (SLP).

While AXS is the governance token, SLP is the uncapped utility token used to breed new axies. “Each time users breed an axie, SLP is consumed,” DappRadar noted. Both tokens can be exchanged for fiat or other cryptocurrencies. This is how gamers based in the Philippines, Venezuela and other developing economies have been earning income via the play-to-earn economy.

Per TheTie, the game is helping Philippines-based users to earn $50 per day. That’s 66% more than the average wage of $30 per day

“It is impressive how ‘hot’ AXS has managed to remain,” said Denis Vinokourov, head of research at Synergia Capital, in an email with CoinDesk.

The NFT ecosystem as well as blockchain-based video games could escape harsh regulatory scrutiny because officials are more focused on decentralized finance, or DeFi, according to Vinokourov. Commodity Futures Trading Commission (CFTC) Commissioner Dan Berkovitz said last month the DeFi markets for derivative instruments – meaning futures contracts – may be illegal in the U.S.

The AXS token has a market capitalization of $1.85 billion. The market value of the NFT-gaming segment is $4.78 billion, or just 10% of the market cap of the decentralized finance sector, per data source Messari.

Of course there are ample risks from holding the AXS tokens in a volatile, still-infant industry where new protocols can be prone to technological glitches and subject to attacks. There’s also the chance that money may rotate into bitcoin (BTC, +4.29%) and other top cryptocurrencies once bullishness returns to the broader crypto market. At present, the wider market is in stasis with bitcoin locked in the range of $30,000 to $40,000.

What Is Axie Infinity (AXS), and Should You Buy It?

Axie Infinity is a NFT-based online video game developed by Vietnamese studio by Sky Mavis, which uses Ethereum-based cryptocurrency AXS (Axie Infinity Shards) and SLP (Smooth Love Potion). Currently it’s the most expensive NFTs collection with more than $42 million in sales in June 2021.

Many cryptocurrencies have seen significant price drops since May. But it seems as if every couple of weeks, there’s an exception. From Keep Network to Baby Doge Coin, a lesser-known crypto will grab the headlines with a massive price jump.

Axie Infinity (AXS) is the latest. Its price shot up almost 550% in just a month. On June 15, it was trading at $4.45 and by July 15 it had hit an all-time high of $28.61. According to CoinMarketCap data, it’s fallen since then and is at $15.03 at the time of writing.

Let’s take a look at why Axie Infinity suddenly rose to fame and whether it’s still a good deal.

Should you buy?

There are a few questions to consider before you buy Axie Infinity.

1. Are you interested in crypto gaming?

As with any investment, it isn’t a great idea to buy something you don’t understand in the hopes that the price will go up. As such, it is important to understand crypto gaming if you want to buy this coin.

It is certainly an interesting segment of the cryptocurrency industry, especially as NFTs have revolutionized the concept of in-game assets. As blockchain technology develops, crypto platforms may be able to host more complex games and we’ll likely see more pay-to-earn coins like Axie.

But there are still several hurdles for the technology to jump. Chief among them is scalability. The majority of applications are built on Ethereum’s network, and until it can upgrade, the platform is congested and transactions are costly.

For Axie, its huge growth has given rise to a few technical troubles. This includes a three-day outage earlier this month.

2. Do you want to participate in Axie?

When you buy crypto, you’re often buying into a community as well as a coin. Several coins are based around the active participation of token owners. If you buy the coin as an investment — without intending to join in — you may not reap the full rewards.

For example, Axie will soon introduce staking. This allows token owners to tie up their coins for a set amount of time and earn interest. However, staking Axie tokens will be linked to your participation — either by playing the game or voting in governance decisions.

Investors earn money from Axie if the value of the coin increases. But Axie gamers are earning money from Axie by actively participating in the game. I would argue that if you are considering buying Axie, at the very least you should understand crypto gaming. And ideally, you should want to play the game.

3. Do you see strong long-term potential?

When a coin soars 550% in a month, you have to wonder how much further it can go. There’s a common pattern of people piling into a coin simply because the price is going up. Not only does this push the price up further, but it also increases the risk that those investors will buy at a high. That’s why it is important to do your own research and think long term.

On paper, Axie has a lot going for it:

- It’s one of the top gaming cryptos by market capitalization.

- Its senior team has experience in both blockchain and gaming.

- It has a whitepaper with a clearly defined roadmap and goals.

- It is making money. According to Token Terminal, which measures the revenue of various protocols,

- Axie Infinity made $40.2 million in the past seven days alone.

- Billionaire and crypto enthusiast Mark Cuban joined Axie’s latest funding round in which it raised $7.5 million.

But that big jump in price makes it feel more of a flash in the pan than a long-term investment. Here are some of the biggest Axie-specific risks:

- Axie may experience more server issues or face different technical problems.

- If the value of Axie falls, participating in the game will not be so lucrative and the community may move on.

- Given the speed of technical development, there’s always the chance a newer game will knock it off the top spot.

4. Are you comfortable buying from a non-U.S. exchange?

Axie is not available from the major U.S. cryptocurrency exchanges. This may change in time, but it means it is difficult for U.S. residents to buy the token.

Buying from exchanges that aren’t licensed to operate in the U.S. carries additional risks. Investors could find themselves unable to sell certain coins or have their accounts frozen altogether.

We may see another price jump if Axie can get listed in the U.S. But for now, it looks like an interesting cryptocurrency to have on your watchlist. Take time to understand the gaming industry and see whether the price stabilizes after that big leap.