- What Can We Expect from the June CPI Inflation Data?

- JPMorgan Sales Team Suggests It’s Better to Bet on Cool US CPI Print Than Hot One: Is It True?

- Is Inflation Really Cooling Down According to the June CPI Report?

- How Will the June CPI Inflation Report Affect the Fed’s Monetary Policy?

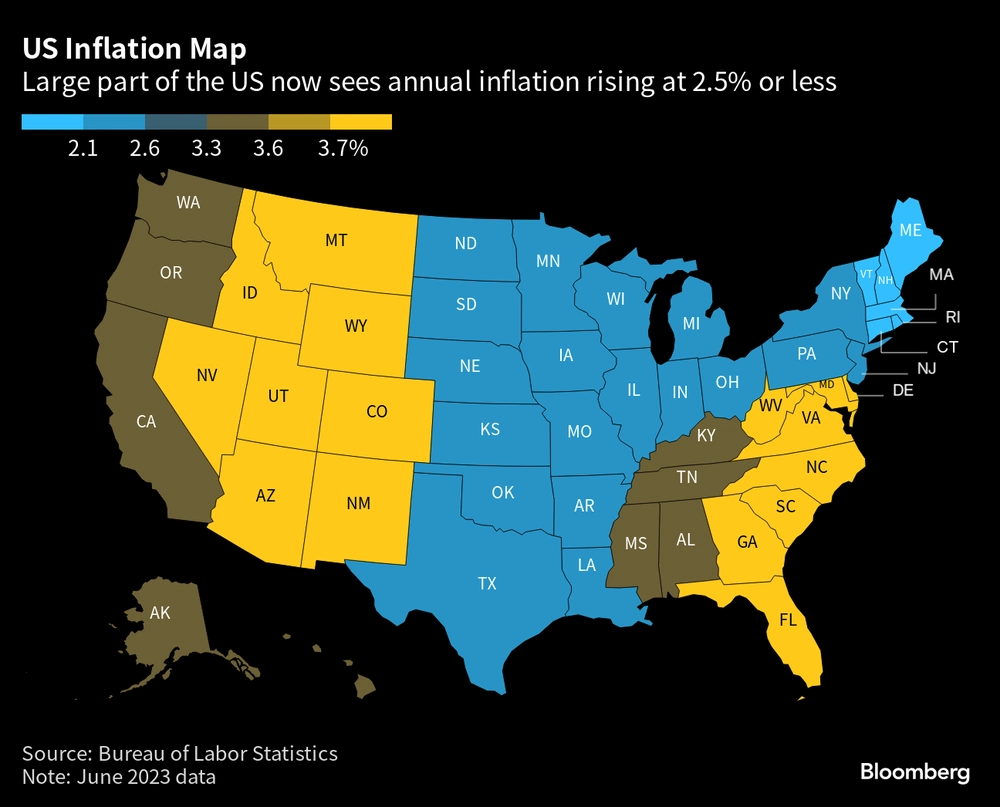

The US economy has been grappling with high inflation rates in recent months, causing concerns among policymakers, investors, and consumers. However, the latest data from the Bureau of Labor Statistics (BLS) shows that inflation may be cooling off, with consumer prices rising at the slowest annual rate since March 2021. In June, the Consumer Price Index (CPI) rose by just 0.2%, which was lower than expected, providing a much-needed break for consumers from the relentless price increases.

Is the US economy finally winning the battle against inflation?

While the news is undoubtedly welcome, it remains to be seen whether this is a temporary reprieve or a sign that the US economy is finally winning the battle against inflation. In this article, we will examine the latest inflation data, what it means for the US economy, and whether the Federal Reserve is likely to change its monetary policy stance in the coming months.

Inflation data for June 2023

The latest CPI data from the BLS shows that consumer prices rose by 0.2% in June, which was lower than economists’ expectations of a 0.3% increase. The annual inflation rate also slowed down to 3%, marking the slowest pace since March 2021. These figures suggest that the US economy may be starting to get a handle on inflation, which has been running hot for much of the year.

When looking at the core inflation rate, which excludes volatile food and energy prices, the increase was also 0.2% in June, which was better than expected. However, the annual core inflation rate remained high at 4.8%, indicating that some sectors of the economy are still experiencing price pressures.

The BLS report also showed that the shelter index, which includes rent and homeowners’ equivalent rent, rose by 0.4% in June, accounting for over 70% of the increase in core inflation. This suggests that the housing market remains a key driver of inflation, and policymakers may need to find ways to address this issue in the coming months.

Is the US economy finally winning the battle against inflation?

The latest inflation data for June suggests that the US economy may be starting to win the battle against inflation. After months of rising prices, the rate of inflation appears to be slowing down, providing much-needed relief for consumers and businesses.

However, it is important to note that the latest data is just a snapshot in time, and it remains to be seen whether this trend will continue in the coming months. Factors such as supply chain disruptions, labor shortages, and rising energy prices could all contribute to higher inflation rates in the future.

Moreover, the core inflation rate remains high, indicating that some sectors of the economy are still experiencing significant price pressures. The housing market, in particular, remains a key driver of inflation, and policymakers may need to find ways to address this issue in the coming months.

What does this mean for the Federal Reserve?

The Federal Reserve has been closely monitoring inflation rates in recent months, and the latest data could influence its monetary policy decisions in the coming months. The central bank has already signaled that it is likely to raise interest rates later this year, and the latest inflation data could provide further support for this move.

However, some economists argue that the latest data may not be enough to convince the Fed to change its stance. For example, Chris Rupkey, chief economist at FWDBONDS, wrote in a note to clients that “the economy is on a safer path today as victory over inflation is in the air. Even core inflation is down in the dumps with a 0.2% rise which is the softest print since August 2021.” He suggests that the Fed may not need to raise rates as aggressively as previously thought.

On the other hand, other economists argue that the Fed needs to act quickly to address inflation concerns. Ryan Sweet, chief US economist at Oxford Economics, told CNBC that “the Fed has painted itself into a corner as Fed officials’ communication has signaled that another rate hike this month is essentially a slam dunk. However, the new data could give the Fed reason to debate whether any further rate hikes after this month are needed.”

Conclusion

The latest inflation data for June suggests that the US economy may be starting to win the battle against inflation. However, it remains to be seen whether this is a temporary reprieve or a sign that the US economy is finally getting a handle on inflation.

The housing market remains a key driver of inflation, and policymakers may need to find ways to address this issue in the coming months. Moreover, the core inflation rate remains high, indicating that some sectors of the economy are still experiencing significant price pressures.

The Federal Reserve will likely continue to monitor inflation rates closely in the coming months, and the latest data could influence its monetary policy decisions. While some economists suggest that the Fed may not need to raise rates as aggressively as previously thought, others argue that the central bank needs to act quickly to address inflation concerns.